Buying a home is an exciting journey, but mistakes along the way can be costly. Chicago’s diverse neighborhoods and competitive housing market require careful planning. To help you avoid common pitfalls, here’s a guide to what not to do when purchasing a home in Chicago.

1. Don’t Skip Mortgage Pre-Approval

One of the biggest mistakes buyers make is starting their home search without getting pre-approved for a mortgage.

Why It’s Important:

- Pre-approval shows sellers that you’re a serious buyer.

- It helps you understand your budget, preventing wasted time on unaffordable properties.

(source: Lansing State Journal)

Pro Tip: Secure your mortgage pre-approval before scheduling showings. In Chicago’s competitive neighborhoods like Logan Square or West Loop, homes move fast, and pre-approval gives you an advantage.

2. Don’t Make Major Financial Changes

Avoid large purchases, changing jobs, or opening new credit accounts during the buying process.

Why It’s Important:

- Mortgage lenders track your credit and financial stability before closing.

- Sudden financial changes could impact your loan approval or alter your mortgage terms.

(source: Simmons Bank)

3. Don’t Waive the Home Inspection

In a hot market, some buyers waive the home inspection to make their offer more appealing. This can be risky, especially in Chicago’s older homes.

Why It’s Important:

- Inspections reveal costly issues such as foundation cracks, outdated electrical systems, or plumbing concerns.

- Skipping this step may leave you facing major repair costs post-purchase.

(source: Halina Latuszek)

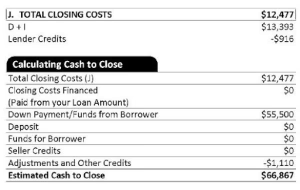

4. Don’t Forget to Budget for Closing Costs

Many buyers focus only on the down payment and overlook additional expenses.

Common Closing Costs Include:

- Title insurance

- Attorney fees (common in Illinois real estate transactions)

- Home appraisal and inspection fees

- Property taxes and insurance

(source: Sirva Mortgage)

Pro Tip: In Chicago, closing costs typically range from 2-5% of the home’s purchase price.

5. Don’t Ignore Neighborhood Research

Choosing the right neighborhood is just as important as selecting the home itself. Factors like school districts, crime rates, and future development can impact your home’s long-term value.

Key Considerations:

- Research walkability and public transit access.

- Explore local dining, retail, and recreational options.

- Investigate planned developments that may affect property values.

(source: LSE Blogs)

6. Don’t Overextend Your Budget

It’s easy to fall in love with a home that stretches your financial limits. However, overextending your budget can lead to long-term stress.

Pro Tip: Use the 28/36 rule — aim to spend no more than 28% of your gross monthly income on housing costs and no more than 36% on total debt obligations.

Tip: There are several budgeting apps that will help make budgeting your finances easy. Click here to watch the video above.

7. Don’t Skip Reviewing HOA Rules (If Applicable)

If you’re purchasing a condo or townhome in Chicago, be sure to review the Homeowners Association (HOA) rules and fees.

Why It’s Important:

- HOA fees can add hundreds of dollars to your monthly expenses.

- Rules regarding pets, rentals, and exterior modifications can impact your lifestyle.

(source: Kuester Management Group)

Conclusion: Be Smart, Stay Prepared

Avoiding these common mistakes will help you navigate the Chicago real estate market with confidence. From financial preparation to thorough research, staying informed is key to making a successful purchase.

Ready to find your ideal home in Chicago? Contact a trusted real estate professional to guide you through the process.