Thinking about selling your property but not sure what’s different about marketing a condo versus a single-family home?

While both types of listings can attract strong buyers, they come with very different expectations, processes, and selling strategies. If you’re not tailoring your approach, you could miss out on the right buyer—or leave money on the table.

Here’s a breakdown of the key differences every seller should know.

1. Who You’re Selling To Is Usually Different

- Condos often attract first-time buyers, young professionals, or downsizers looking for low maintenance and shared amenities.

- Single-family homes usually draw families, long-term buyers, or those prioritizing space and privacy.

Knowing your target audience helps shape everything from listing photos to your marketing language.

2. Condo Sales Include HOA Documents and Rules

Selling a condo means providing:

- HOA disclosures

- Association meeting minutes

- Financials and reserve studies

- Rules and regulations (pets, rentals, renovations)

Buyers will want to know exactly what they’re getting into—fees and all.

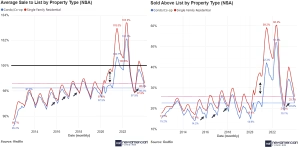

3. Your Pricing Strategy Needs to Reflect the Property Type

Condos are often priced based on:

- Price per square foot

- Building amenities

- Floor level and view

- Comparable units in the same complex

Single-family homes rely more on:

- Lot size

- Condition of the home

- Neighborhood comps

- School districts and local demand

Working with a local agent who understands both markets is crucial.

4. Staging and Photography Should Match the Lifestyle

- Condos should highlight open layouts, building amenities, and city lifestyle.

- Homes should showcase space, privacy, yard potential, and community feel.

Each buyer is picturing a different lifestyle—your photos should reflect that.

5. The Sales Timeline Might Be Different

Condos can sometimes take longer to close due to:

- HOA document delays

- Additional lender requirements

- Buyer review periods for disclosures

Plan ahead to avoid delays that could cost you a serious buyer.

Bottom Line: Know the Property—Play to Its Strengths

Selling a condo or a single-family home in Chicago comes down to knowing your audience, managing expectations, and positioning the property the right way. With the right strategy, both can lead to fast, profitable sales.

Need help listing your condo or home with the right approach? Reach out today and we’ll tailor a marketing plan that fits your property, your goals, and your timeline.