Every week, I hear the same thing from Chicago buyers:

“We’re going to wait until rates drop.”

Totally understandable — but here’s the part most people miss:

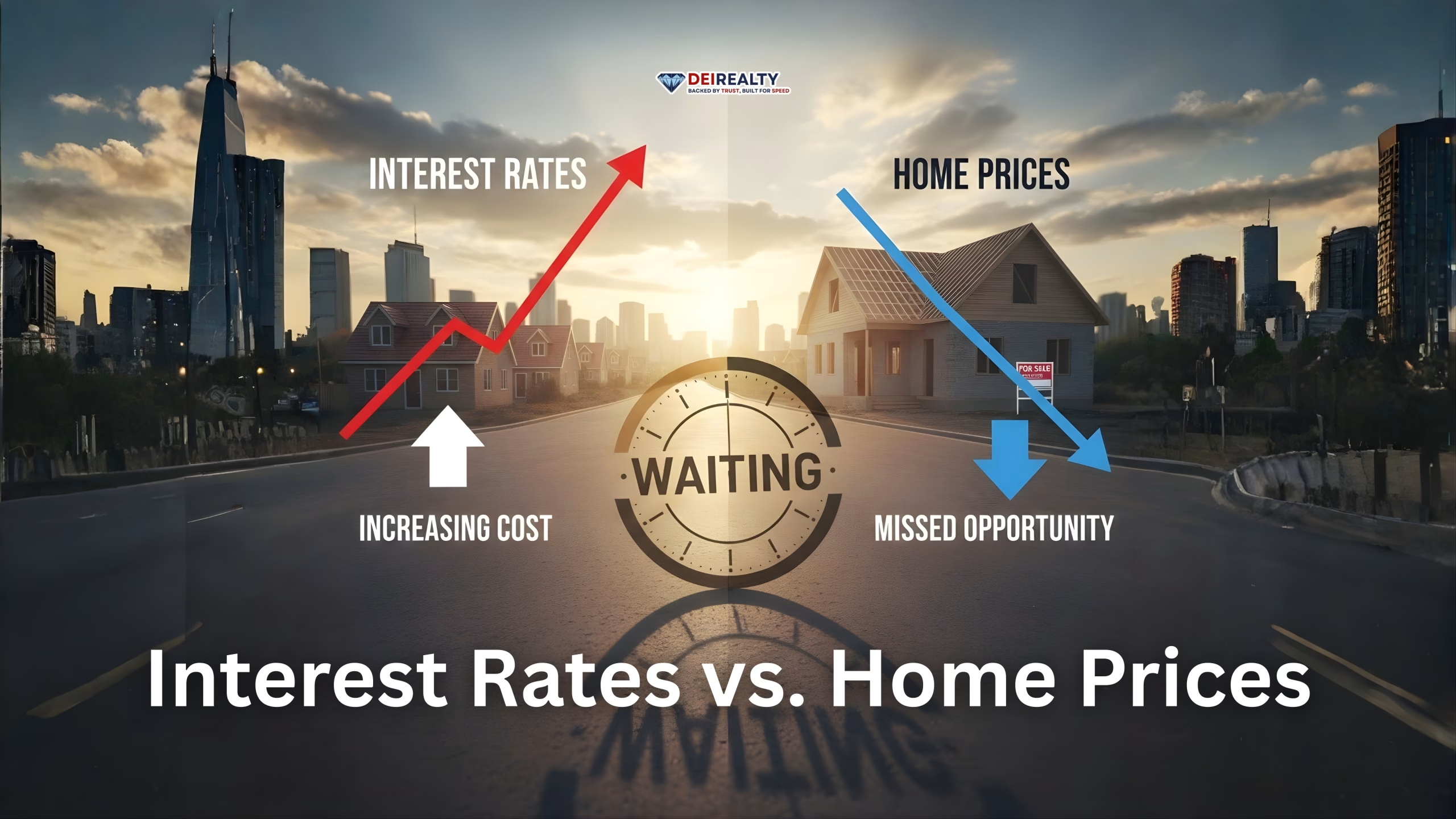

✅ Interest rates are only half the equation.

The real cost of waiting comes from what happens at the same time:

-

Home prices shift (even slightly)

-

Competition returns fast

-

Negotiating power disappears

-

You lose months of equity-building and leverage

In Chicago, waiting isn’t neutral.

It’s a decision that has a price tag.

The trap: assuming rates drop in a vacuum

When rates drop, buyers don’t calmly re-enter the market…

They rush back in.

That usually means:

-

more offers

-

tighter deadlines

-

fewer seller credits

-

higher “final sale price” than the list price you thought was fair

So yes — a lower interest rate can reduce the cost of borrowing…

…but it often comes with:

a higher purchase price and worse terms.

Chicago makes it even more intense: it’s a neighborhood-by-neighborhood game

Chicago isn’t one market — it’s dozens of micro-markets.

Even when the overall market slows down, high-demand pockets can stay competitive because of:

-

inventory shortages

-

school-zone demand

-

transit access

-

lifestyle neighborhoods (walkability, restaurants, parks)

So while people wait for a “perfect rate,” the neighborhoods they actually want are still moving.

The silent cost nobody counts: the equity you don’t build

Here’s what waiting usually costs buyers:

-

months of rent payments that don’t build ownership

-

lost time paying down principal

-

missed appreciation (even small gains matter over time)

-

delayed ability to refinance later

Because the buyer who buys now gets an option later:

✅ Refinance if rates drop

✅ Already owns the home

✅ Already built equity

✅ Already locked the location

The buyer who waits starts from scratch later — often in a hotter environment.

The smarter question isn’t “Should I wait?”

It’s this:

“Can I buy smart now, then refinance later if rates improve?”

That approach gives you control instead of relying on perfect timing.

Why this matters to DEI Realty (and why we talk about it)

At DEI Realty, we’re not here to “sell urgency.”

We’re here to help Chicago buyers make decisions based on real numbers, not headlines.

That’s exactly what the DEI Lead Generation Manual is designed to do — build trust through education, visibility, and consistent market authority (not generic marketing).

Chicago buyer takeaway

If you’re waiting for rates to drop, here’s what you should watch just as closely:

✅ the price trends in the neighborhoods you want

✅ how fast listings are going under contract

✅ how many concessions sellers are actually giving

✅ the cost of being “on the sidelines” another 6 months

Because the real cost of waiting isn’t the rate.

It’s what the market does while you’re waiting.

If you want the “Buy Now vs Wait” math broken down for your exact situation

That’s what we do every day at DEI Realty — neighborhood-specific, payment-specific, and strategy-driven.