In a year marked by persistent affordability challenges and fluctuating mortgage rates, expanded down payment assistance programs are making headlines as a game-changer for homebuyers across the United States.

A New Era of Support for Buyers

As of September 2025, federal, state, and local governments—as well as private organizations—have significantly increased funding and eligibility for down payment assistance (DPA) programs. These initiatives are designed to help first-time buyers, moderate-income families, and even some repeat buyers overcome the most significant barrier to homeownership: the initial cash needed for a down payment.

Key Features of 2025’s Expanded Programs:

- Higher Maximum Assistance: Many programs now offer grants or forgivable loans of $15,000–$25,000, up from previous averages of $5,000–$10,000.

- Broader Eligibility: Income limits have been raised, and some programs now include repeat buyers who haven’t owned a home in the past three years.

- Streamlined Application Processes: Digital platforms and partnerships with lenders have made it easier and faster for buyers to apply and receive funds.

- Targeted Support: Special incentives are available for essential workers, veterans, and buyers in revitalization zones.

Impact on the Market

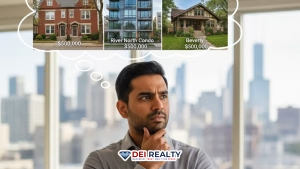

Real estate professionals report a noticeable uptick in buyer activity, especially among younger adults and families who had previously been priced out. “We’re seeing more clients able to make competitive offers and move forward with confidence,” says Maria Chen, a Chicago-based agent. “These programs are leveling the playing field.”

What Buyers Should Know

- Research Local Options: DPA programs vary by state and city. Buyers should consult with their lender or a housing counselor to identify all available resources.

- Prepare Documentation: Most programs require proof of income, employment, and completion of a homebuyer education course.

- Act Quickly: Some programs have limited funding and operate on a first-come, first-served basis.

Looking Ahead

With affordability still a concern in many markets, expanded down payment assistance is expected to remain a vital resource for buyers through the end of 2025 and beyond. Experts recommend that anyone considering a home purchase this year explore these programs early in their search.