If you’ve been eyeing Chicago real estate with a $500,000 budget, you’re in a sweet spot. This price point opens doors to a surprising variety of homes across some of the city’s most desirable neighborhoods—from spacious single-family homes in family-friendly areas to modern condos in the heart of downtown. With the Chicago metro area’s median sales price forecast to rise almost 5% to $386,972 through 2026, understanding what your money can buy right now is more important than ever.

The Current State of Chicago’s Market

Before we dive into specific neighborhoods and properties, let’s look at where the market stands today. The median sale price of a home in Chicago was $365K last month, down 1.4% since last year, making your $500,000 budget significantly above the median—meaning you’ll have excellent options.

The market is showing encouraging signs for buyers:

- Closed home sales are projected to increase 5.1% compared with 2025, signaling stronger market activity

- Homes in Chicago receive 2 offers on average and sell in around 57 days, giving buyers time to make informed decisions

- Inventory has been tightening, but opportunities remain across various neighborhoods

- Mortgage rates are expected to settle around the low-to-mid 6% range in 2026, improving affordability

What makes the $500,000 price point particularly attractive is that buyers have more leverage in negotiations, especially in the $400K–$600K price range as inventory increases modestly.

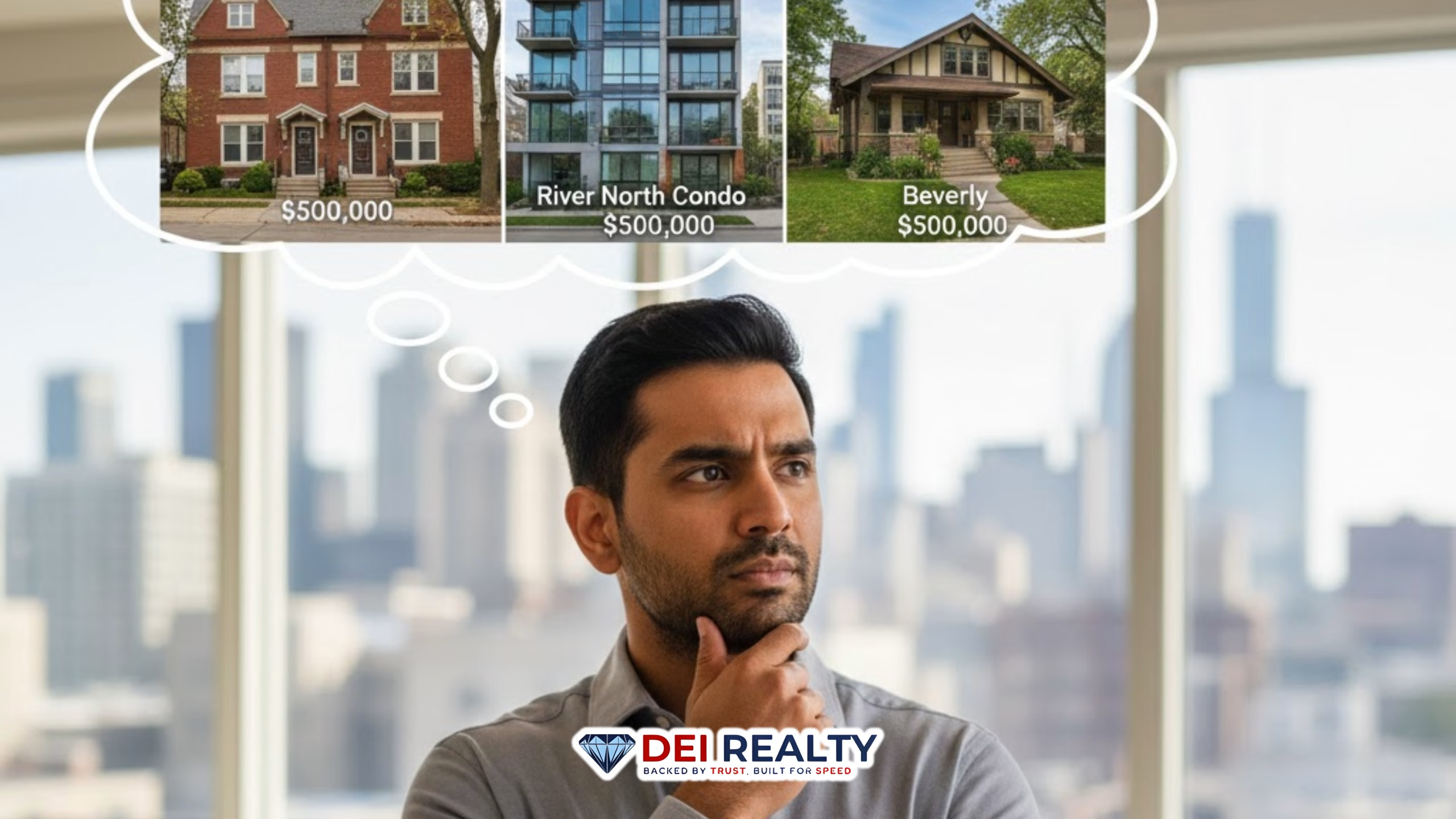

What $500k Looks Like Across Chicago Neighborhoods

Your $500,000 budget positions you well above Chicago’s median, opening up a diverse range of options. Here’s what you can expect in different areas:

North Side Gems: Edison Park and Lincoln Square

Edison Park is one of Chicago’s safest neighborhoods, offering large single-family homes with well-maintained yards. With median prices around $446,771 and an unemployment rate of just 1.2%, Edison Park is 99% safe—making it ideal for families prioritizing safety and community.

With your $500k budget in Edison Park, you can expect:

- 3-4 bedroom single-family homes with yards

- Well-established neighborhoods with mature trees

- Excellent local schools like Stock School

- A suburban feel while staying within city limits

- Properties with recent updates or move-in ready condition

Lincoln Square offers a charming, small-town feel on Chicago’s North Side. This neighborhood is perfect for families and young professionals who love community events like the Lincoln Square Farmers Market and the annual Apple Fest.

At $500k in Lincoln Square, you’ll find:

- Historic bungalows with character and charm

- Modern condos with updated finishes

- Tree-lined streets and walkable neighborhoods

- Easy access to the vibrant shopping and dining district near Lawrence and Western

- Properties near River Park with its pools and recreational facilities

South Side Value: Beverly

Beverly stands out as one of the best neighborhoods for families looking for value and community. With a median price of $300,525 and an 88% safety rating, Beverly features traditional brick bungalows and Colonial and Craftsman-style homes.

Your $500k budget in Beverly is substantial and can get you:

- Large 4-5 bedroom single-family homes, significantly above the neighborhood median

- Historic properties with distinctive architectural details

- Spacious lots with mature landscaping

- Access to top-rated schools like Sutherland Elementary and Kellogg Elementary

- Homes near green spaces like the 257-acre Dan Ryan Woods

- Move-in ready properties with modern updates or charming fixer-uppers with tremendous potential

Beverly’s Irish heritage adds unique character, with community events like the South Side Irish Parade and the seasonal 95th Street Farmers Market creating a tight-knit community feel.

Up-and-Coming Neighborhoods with Strong Growth Potential

Neighborhoods like Bronzeville, South Shore, and Avondale are likely to experience above-average appreciation due to increased demand and ongoing revitalization efforts. These areas offer excellent value for buyers looking to build equity.

Bronzeville is experiencing a renaissance with new developments and historic renovation projects. Your $500k here can buy:

- New construction condos in the Historic Blues District with high-end finishes

- Renovated multi-unit buildings (2-4 flats) with rental income potential

- Spacious single-family homes in various stages of renovation

- Properties near transportation hubs and growing commercial districts

Avondale provides a perfect blend of urban convenience and neighborhood charm. With $500k, expect:

- Recently updated single-family homes with modern kitchens and baths

- Multi-unit properties ideal for owner-occupants or investors

- Easy access to the Kennedy Expressway and Blue Line

- Walkable streets with local restaurants and shops

Downtown Living: River North, South Loop, and The Loop

Neighborhoods like River North, the Loop and South Loop currently offer more inventory at a better value compared to other downtown hotspots like Lincoln Park and Lake View.

With $500k in these downtown neighborhoods, you’re looking at:

River North:

- 2-bedroom, 2-bathroom condos with modern finishes

- Sweeping city views from higher floors

- Updated kitchens and bathrooms

- In-unit laundry and parking (in most buildings)

- Walkability to restaurants, galleries, and nightlife

South Loop:

- Bright, split-bedroom condos ideal for roommates or home offices

- Proximity to Grant Park, museums, and lakefront trails

- Building amenities like fitness centers and roof decks

- Easy access to public transportation

The Loop:

- Urban condos with skyline views

- Historic building conversions with unique architectural details

- The ultimate downtown lifestyle with work, entertainment, and culture at your doorstep

Logan Square and Wicker Park: Creative and Cultural Hubs

These trendy neighborhoods attract young professionals, artists, and families who appreciate culture, dining, and nightlife. At $500k, you can find:

- Victorian homes and craftsman-style properties with historic charm

- Renovated condos in vintage buildings

- Properties with original details like exposed brick and hardwood floors

- Rooftop decks with skyline views

- Walkable access to the Milwaukee Avenue corridor with its restaurants and shops

Property Types Within Your $500k Budget

Single-Family Homes

In neighborhoods like Beverly, Mount Greenwood, Edison Park, and parts of the Northwest Side, $500k provides access to:

- 3-4 bedroom homes with 1,800-2,500 square feet

- Full basements, some finished for additional living space

- Private yards, perfect for families with children or pets

- Garages or dedicated parking

- Recent updates or solid bones for renovation

Multi-Unit Properties (2-4 Flats)

Chicago’s classic two-flat and three-flat buildings offer unique opportunities:

- Live in one unit and rent out the others to offset your mortgage

- Generate passive income while building equity

- Common in neighborhoods like Humboldt Park, Logan Square, Avondale, and Austin

- Typically offer 6-12 total bedrooms across all units

- Strong rental demand ensures steady income

With average rents rising steadily and projected to increase another 3.5% to 5.2% through 2026, income-generating properties—especially two- to four-unit buildings in these neighborhoods offer favorable returns.

Condos and Townhomes

For those seeking low-maintenance living or downtown locations:

- 2-3 bedroom condos ranging from 1,200-1,800 square feet

- Townhome-style residences with private outdoor spaces

- Building amenities like fitness centers, door staff, and parking

- HOA fees typically range from $200-$600/month depending on amenities

- Prime locations in River North, South Loop, Lincoln Park, and Lakeview

Investment Potential

The $500k price point isn’t just attractive for homeowners—it’s also compelling for investors. Here’s why:

Appreciation Potential: Home prices are projected to increase by 2.5% to 4.5% through 2026, with the current median home value around $297,772 translating to an estimated price range of $305,200 to $311,200 by early 2026. Your $500k investment should see similar appreciation, especially in revitalizing neighborhoods.

Rental Income: Chicago’s strong rental market supports investment properties. Multi-unit buildings in the $400k-$600k range can generate $2,000-$4,000+ in monthly rental income depending on the neighborhood and number of units.

Below National Average Pricing: Chicago’s median sale price is 16% lower than the national average, offering more value per dollar than coastal markets.

Current Market Conditions Favor Strategic Buyers

While current hotspots include Lincoln Park, Lake View and Old Town, savvy buyers with $500k budgets should also consider:

Areas with Better Value:

- River North, Loop, and South Loop for downtown living

- Beverly and Edison Park for family-friendly communities

- Bronzeville and Avondale for appreciation potential

- Logan Square and Wicker Park for lifestyle and culture

Market Dynamics Working in Your Favor:

- The average homes sell for about 1% below list price and go pending in around 59 days, giving you negotiating power

- More time to conduct due diligence without multiple-offer pressure

- Sellers are more willing to negotiate on price or offer concessions

- The market is shaping up to be balanced, letting sellers get strong offers while still giving buyers choices

What to Expect When House Hunting with $500k

Timeline and Process

Based on current market conditions, here’s what your home search might look like:

Weeks 1-2: Getting Pre-Approved and Defining Your Criteria

- Work with a lender to get pre-approved for your $500k budget

- Factor in closing costs (typically 2-5% of purchase price)

- Define must-haves vs. nice-to-haves

- Research neighborhoods that align with your lifestyle

Weeks 3-6: Active House Hunting

- Tour 10-15 properties across different neighborhoods

- With homes spending around 57 days on market, you’ll have time to consider each property carefully

- Attend open houses to get a feel for different areas

- Work with a local agent who knows the neighborhoods well

Weeks 7-9: Making Offers and Negotiations

- Most properties receive an average of 2 offers, so competition exists but isn’t overwhelming

- Consider home inspection, financing, and appraisal contingencies

- Be prepared to negotiate—sellers are more realistic about pricing in 2026

- Factor in potential repairs or updates when making your offer

Weeks 10-12: Closing

- Complete home inspection and negotiate any necessary repairs

- Finalize financing and ensure appraisal comes in at purchase price

- Conduct final walk-through

- Close on your new home!

Common Mistakes to Avoid

1. Overlooking Neighborhoods Outside Trending Areas

Buyers should be flexible when it comes to details such as location—maybe that fixer-upper is a good thing right now, and buying outside of hot areas may not be so bad at all. Some of the best values exist in transitioning neighborhoods.

2. Maxing Out Your Budget

While you may be approved for $500k, consider properties in the $425k-$475k range to leave room for:

- Closing costs and moving expenses

- Immediate repairs or updates

- Emergency fund maintenance

- Property taxes (Chicago’s property taxes are significant)

3. Ignoring Property Taxes

Cook County property taxes are among the highest in the nation. A $500k home might have annual property taxes of $10,000-$15,000 depending on the neighborhood. Factor this into your monthly budget.

4. Skipping the Home Inspection

Even in competitive situations, never waive your home inspection. Chicago has many older homes with potential issues (roofs, plumbing, electrical, foundation) that require professional assessment.

Financing Your $500k Home

Mortgage Options

At current rates in the low-to-mid 6% range, here’s what your monthly payment might look like on a $500k home:

Conventional Loan (20% down = $100k):

- Loan amount: $400,000

- Estimated monthly payment: $2,400-$2,600 (principal + interest)

- Add property taxes ($800-$1,200/month) and insurance ($100-$200/month)

- Total monthly payment: $3,300-$4,000

FHA Loan (3.5% down = $17,500):

- Loan amount: $482,500

- Estimated monthly payment: $2,900-$3,100 (principal + interest)

- Add PMI ($400-$500), property taxes, and insurance

- Total monthly payment: $4,200-$4,800

Income Requirements:

Using the 28/36 rule (housing costs shouldn’t exceed 28% of gross monthly income), you’d need:

- For conventional: $140,000-$170,000 annual household income

- For FHA: $180,000-$205,000 annual household income

Down Payment Assistance Programs

Chicago offers several programs that can help with down payments:

The Building Neighborhoods and Affordable Homes Program (BNAH) provides up to $100,000 in purchase price assistance to qualifying buyers for newly constructed homes built pursuant to City agreements.

Other programs include:

- City of Chicago ARO Program

- IHDA 1stHomeIllinois

- Illinois Housing Development Authority programs

Neighborhood Spotlights: Deep Dives

Beverly: The Family-Friendly South Side Treasure

Beverly consistently ranks as one of Chicago’s best neighborhoods for families, and $500k goes incredibly far here.

What Makes Beverly Special:

- Strong sense of community with annual events and farmer’s markets

- Historic architecture with well-preserved homes from the early 1900s

- Excellent public and private school options

- Access to the Metra for easy downtown commutes

- Ridge Historic District with stunning views

Your $500k in Beverly: Since the median is around $300k, your budget puts you well above average. Expect:

- 4-5 bedroom homes with 2,500-3,500 square feet

- Large lots (often 50×125 feet or larger)

- Finished basements adding significant living space

- Original architectural details (built-in bookcases, hardwood floors, crown molding)

- Two-car garages

- Recent kitchen and bathroom updates

Beverly Lifestyle:

- Walk to The Original Rainbow Cone for iconic Chicago ice cream

- Dine at Nicky’s of Beverly for Mediterranean cuisine

- Enjoy craft beer at Open Outcry Brewing Company

- Explore Dan Ryan Woods with 257 acres of trails and green space

- Shop locally at seasonal farmer’s markets

Edison Park: Safe, Suburban Feel in the City

Edison Park offers the perfect blend of suburban tranquility with city convenience.

Why Edison Park?

- Consistently ranked among Chicago’s safest neighborhoods

- Strong community organization and active residents

- Excellent schools and family-friendly atmosphere

- Metra access for downtown commutes

- Mix of brick bungalows and larger single-family homes

Your $500k in Edison Park: With medians around $447k, you’re right in the sweet spot:

- 3-4 bedroom brick bungalows or single-family homes

- 1,800-2,200 square feet

- Attached garages and driveways

- Well-maintained yards and mature trees

- Proximity to parks and schools

- Move-in ready condition

Bronzeville: Historic Charm Meets Modern Development

Bronzeville, once known as the “Black Metropolis,” is experiencing a cultural and real estate renaissance.

Bronzeville’s Appeal:

- Rich African American history and culture

- New construction alongside historic renovation

- Growing commercial corridor with restaurants and shops

- Proximity to downtown and lakefront

- Green Line access

Your $500k in Bronzeville:

- New construction condos in buildings like The Blues District Collection

- Completely renovated historic graystones

- 2-4 unit buildings with strong rental potential

- 2-3 bedroom condos with high-end finishes

- Properties near Washington Park and cultural institutions

Bronzeville is positioned for growth as revitalization efforts continue and more buyers discover its value proposition.

Logan Square: Creative Hub with Urban Energy

Logan Square has evolved into one of Chicago’s trendiest neighborhoods while maintaining its residential character.

Logan Square Attractions:

- Milwaukee Avenue’s dining and nightlife scene

- Independent boutiques and coffee shops

- The iconic Logan Square Monument (boulevards)

- Easy access to Blue Line

- Mix of young professionals and growing families

Your $500k in Logan Square:

- Victorian homes or craftsman bungalows with character

- 2-3 bedroom condos in renovated buildings

- Properties with original details (exposed brick, hardwood floors, high ceilings)

- Potential for rooftop decks with city views

- Multi-unit buildings for owner-occupants

Monthly Cost Breakdown: What to Budget

Let’s break down the total monthly costs for a $500k home in Chicago:

Mortgage Payment (assuming 20% down, 6.25% rate): $2,462

Property Taxes (varies by neighborhood):

- Beverly/Edison Park: $800-$1,000/month

- Downtown condos: $600-$800/month (part of HOA sometimes)

- Average: $900/month

Homeowners Insurance: $150-$250/month

HOA Fees (if applicable): $200-$600/month for condos

Utilities:

- Gas/Electric: $100-$200/month

- Water: $50-$100/month

- Internet/Cable: $100-$150/month

Maintenance Reserve: $200-$300/month (1% of home value annually)

Total Monthly Cost: $3,962-$5,162

This means you’d need a household income of approximately $150,000-$195,000 to comfortably afford a $500k home in Chicago.

Tips for Success in Chicago’s $500k Market

1. Work with a Local Expert

Chicago’s neighborhoods vary dramatically. Partner with a real estate agent who specializes in the specific areas you’re considering. They’ll know about upcoming developments, school changes, and neighborhood trends that can impact your investment.

2. Consider Your Commute

Chicago offers excellent public transportation, but your daily commute matters. Factor in:

- CTA train lines (Red, Blue, Brown Lines are most convenient)

- Metra stations for suburban-style living within city limits

- Parking availability if you’re driving

- Bike lanes and walkability scores

3. Think Long-Term

With prices forecast to rise and sales activity increasing, the market is strengthening heading into 2026. Buy a home you can see yourself in for at least 5-7 years to ride out market fluctuations and build equity.

4. Don’t Overlook Condos

While single-family homes get a lot of attention, condos offer:

- Lower maintenance responsibilities

- Building amenities (gyms, doormen, party rooms)

- Downtown locations that would be unaffordable otherwise

- Strong rental demand if you decide to move

5. Factor in Renovation Costs

Maybe that fixer-upper is a good thing right now. Chicago has many solid older homes that need cosmetic updates. If you’re handy or can manage a renovation, you might find better value in a home that needs work.

Typical renovation costs to budget:

- Kitchen remodel: $25,000-$60,000

- Bathroom remodel: $10,000-$25,000

- Roof replacement: $8,000-$15,000

- New HVAC system: $5,000-$10,000

- New windows: $5,000-$15,000

6. Understand Chicago’s Housing Stock

Many Chicago homes were built between 1890-1930 and feature:

- Brick or masonry construction (very durable)

- Boiler heating systems

- Older plumbing and electrical that may need updates

- Full basements (potential for additional living space)

- Hardwood floors throughout

These characteristics are part of Chicago’s charm but require maintenance. Budget accordingly and have a thorough home inspection.

The 2026 Outlook: Timing Your Purchase

Market conditions suggest that 2026 is expected to bring more movement and more opportunity for buyers and sellers alike.

Why Now Might Be a Good Time:

- Balanced Market Conditions: Neither buyers nor sellers have overwhelming advantage, creating fair negotiations

- Inventory Improvements: More choices are becoming available after years of tight inventory

- Rate Stabilization: Mortgage rates have stabilized and may edge lower throughout the year

- Equity Building: This growth rate reflects a balanced market—steady enough to protect equity without creating volatility

Considerations for Waiting:

- Potential Rate Decreases: If rates drop to low 6% or high 5% range, you could refinance

- More Inventory: Spring typically brings more listings

- Economic Uncertainty: Monitor national economic conditions

However, remember: trying to time the market perfectly is nearly impossible. If you find the right home at a fair price and can afford the monthly payments, that’s likely a better decision than waiting for “perfect” conditions that may never materialize.

Final Thoughts: Making Your $500k Work for You

With a $500,000 budget in Chicago, you’re positioned to find an excellent home in a wide variety of neighborhoods. Whether you prioritize:

- Safety and schools → Edison Park or Beverly

- Downtown lifestyle → River North, South Loop, or West Loop

- Appreciation potential → Bronzeville, Avondale, or Pilsen

- Culture and dining → Logan Square or Wicker Park

- Space and value → Northwest or Southwest Side neighborhoods

…Chicago offers something that matches your needs.

The key to success is understanding that Chicago offers a rare combination of affordability, rental demand, economic stability, and neighborhood diversity that few other major metropolitan areas can match.

With median home prices under $350,000, Chicago is significantly more accessible than coastal markets, and your $500k budget positions you well above the median with plenty of attractive options.

As you embark on your home search, work with experienced local professionals who understand Chicago’s unique neighborhoods and market dynamics. Take your time, do thorough research, and don’t be afraid to explore neighborhoods you might not have initially considered.

Your next home is out there—and with $500k in today’s Chicago market, you have excellent opportunities to find exactly what you’re looking for.

Ready to start your Chicago home search? Connect with a local real estate expert who can show you what $500k can buy in the neighborhoods that match your lifestyle and goals. The market is active, inventory is improving, and 2026 could be the year you find your perfect Chicago home.