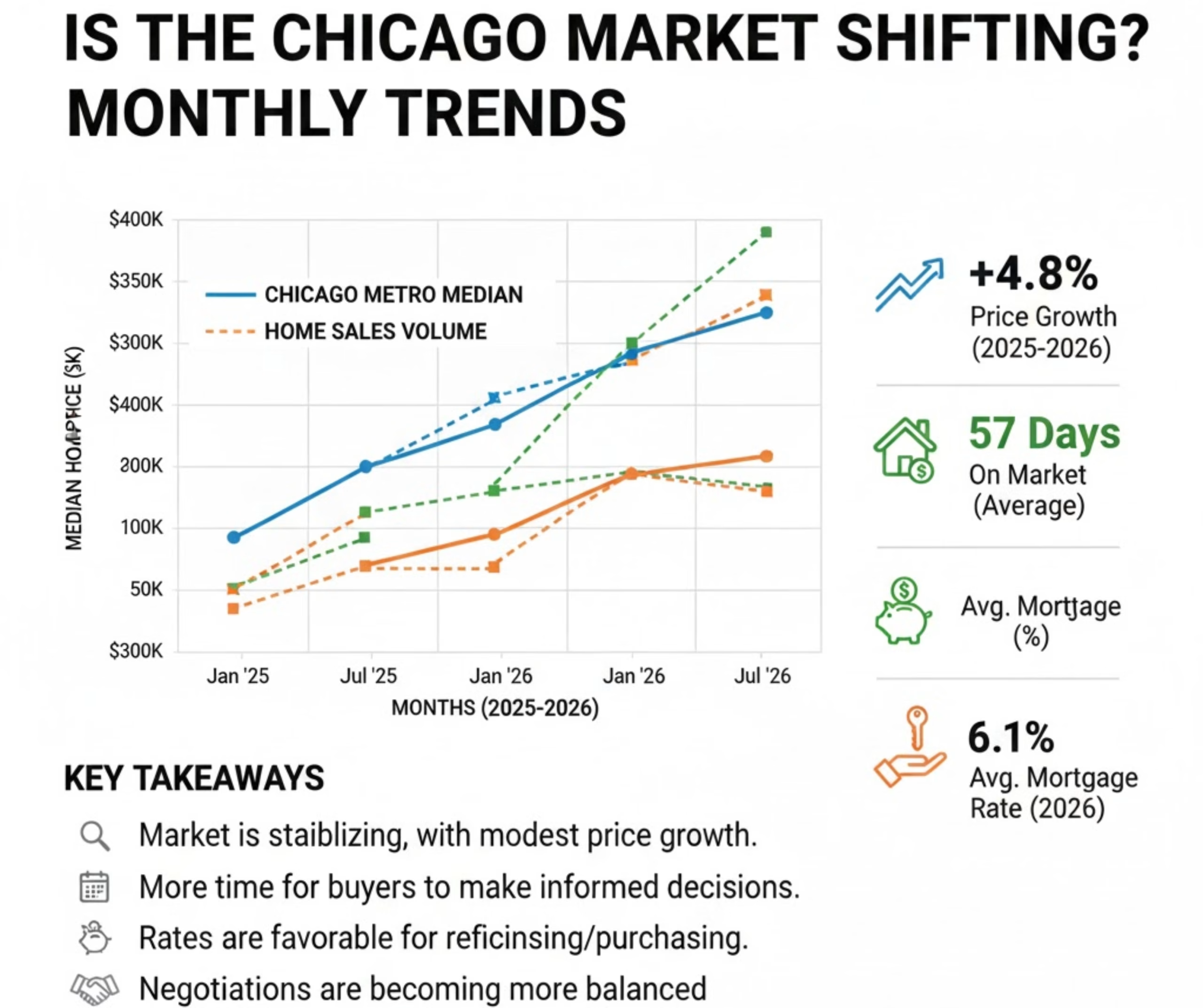

As we step into 2026, the Chicago real estate market continues to signal important shifts — and understanding these trends is key for buyers, sellers, and investors alike.

1. Prices: Modest Growth With Mixed Signals

Recent data shows that median home prices in Chicago have experienced moderate movement, though the pace varies by source. Some reports cite a slight year-over-year increase, while others show slight declines or stagnation in median price figures.

-

According to Redfin, the median sale price was about $365,000, which is down 1.4% year-over-year but homes are selling faster than last year.

-

Zillow data shows average home values up about 2.2% over the past year.

Overall, price growth is modest — not the rapid appreciation seen in past years but also not a steep decline.

2. Sales Activity: Slowing Volume, Faster Movement

One of the clearest signs of a market shift is in transaction volume and days on market:

-

Homes are taking fewer days to sell than a year ago, suggesting continuing demand.

-

Despite faster movement, total units sold have decreased, indicating that fewer buyers are transacting overall compared to prior periods.

This dynamic — slower overall sales but quicker turnovers — often points to selective demand, where motivated buyers compete even as broader buyer participation softens.

3. Inventory & Affordability

Inventory remains elevated relative to low-supply periods, giving buyers more choice and negotiating power.

At the same time, affordability constraints — driven by mortgage rates that remain well above pandemic lows — continue to shape buyer behavior. National trends show mortgage rates hovering around 6% with some stabilization but still above historic norms.

This combination — more homes available but higher borrowing costs — can dampen buying urgency and redirect demand into rental or pricing-sensitive segments.

4. Sector & Submarket Nuances

Chicago’s real estate landscape is not monolithic:

-

Condo vs. Single-Family: Some condo prices have risen even when single-family homes lag, reflecting differing demand drivers in urban vs. suburban segments.

-

Neighborhood variation also matters — central urban cores with strong job growth and rental demand can outperform other submarkets.

This nuanced picture highlights why hyper-local data matters more than broad headline trends.

5. Forecast: Stable but Not Static

Looking ahead, most forecasts suggest modest price growth or stability rather than dramatic swings:

-

Projections show median prices holding steady or rising slightly through 2026, with some models estimating mild appreciation over the next 12 months.

However, external factors such as broader U.S. economic trends and interest rate expectations will continue to influence Chicago’s real estate trajectory.

Market Takeaways — What This Means Now

For Buyers:

-

Market conditions are not overwhelmingly favorable or unfavorable — buyers with financing in place and realistic pricing expectations can find opportunities, particularly where inventory is higher or pricing has softened.

For Sellers:

-

Pricing must reflect localized competition. Homes that are priced appropriately and marketed well can still sell quickly, but lingering on the market can erode leverage.

For Investors:

-

Chicago’s market shows long-term fundamentals still intact (diverse economy, rental demand), even as short-term activity softens. Submarkets with strong rental dynamics or redevelopment initiatives may offer resilient returns.

Bottom Line

The Chicago market is shifting — but not crashing. Trends point toward moderation and selectivity rather than dramatic downturns or runaway growth. Staying updated with monthly data — especially median prices, days on market, and inventory changes — will be crucial for strategic decision-making in the months ahead.