Rising interest rates have become one of the most significant factors influencing the real estate market across the country, including Chicago. As we move into 2025, understanding how these rates affect home prices is crucial for both buyers and sellers. Here’s a closer look at the impact and what you can do to navigate these changes.

1. How Interest Rates Impact Buying Power

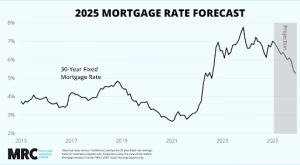

Mortgage rates play a direct role in determining affordability for homebuyers. As rates increase, monthly mortgage payments rise, reducing the overall purchasing power for buyers.

According to Freddie Mac, average mortgage rates climbed to 7.2% by late 2024, up from 5.9% the previous year. Experts predict rates may stabilize in 2025, but higher borrowing costs are likely to persist.

(source: mortgageresearch.com image)

Impact on Buyers:

- A buyer who could afford a $400,000 home at 5% may only qualify for a $350,000 home at 7% due to higher monthly payments.

- First-time buyers may need to explore budget-friendly options or expand their search to less competitive markets.

Impact on Sellers:

- Sellers may need to price their homes more competitively as fewer buyers can afford higher-priced listings.

- Expect longer days on the market if demand cools.

2. Home Prices in Response to Rising Rates

Historically, rising interest rates tend to slow home price growth. According to data from Zillow, Chicago home prices rose 5.3% in 2024 but are expected to cool to 2-3% in 2025 as affordability declines.

(source: Chicago Tribune)

For Buyers: While prices may soften, demand in desirable neighborhoods like South Loop and Wicker Park is expected to remain competitive.

For Sellers: Be prepared to offer incentives like covering closing costs or including home warranties to attract buyers.

3. Increased Demand for Adjustable-Rate Mortgages (ARMs)

With fixed mortgage rates rising, some buyers are turning to adjustable-rate mortgages (ARMs) for initial savings. According to Bankrate, ARMs comprised 20% of mortgage originations in late 2024, a sharp increase from previous years.

(source: Freddie Mac)

Pros of ARMs:

- Lower introductory rates can reduce monthly payments early on.

- Beneficial for buyers who plan to sell or refinance before the adjustable period starts.

Cons of ARMs:

- Rates can increase significantly after the introductory period, so timing is key.

4. Luxury and High-End Market Resilience

While higher interest rates are slowing demand in entry-level markets, luxury real estate in Chicago’s affluent areas like Gold Coast, Lincoln Park, and Streeterville remains stable.

(source: Zillow)

Wealthier buyers are often less dependent on financing, allowing these segments to resist broader market shifts.

5. Rental Demand is Surging

As mortgage rates rise, many would-be homebuyers are opting to rent instead. According to RENTCafé, Chicago rental prices increased 8% year-over-year in 2024, with further growth expected in 2025.

(source: Zillow)

For investors, this trend presents an opportunity to expand rental property portfolios, especially in high-demand areas like West Loop and River North.

Conclusion: Adapting to a Changing Market

Rising interest rates are reshaping the Chicago housing market, creating challenges for both buyers and sellers. Buyers should explore budget-conscious strategies, while sellers may need to offer incentives to stand out.

For expert advice on navigating the Chicago market in 2025, reach out to a local real estate professional who can guide you through this evolving landscape.